In the last decade, artificial intelligence (AI) has emerged not merely as a technological evolution but as a transformative force reshaping global economies, societal structures, and investment patterns. AI startups, once considered niche players in the tech domain, are now recognized as pivotal drivers of innovation, attracting billions in venture capital and redefining market strategies. This comprehensive article delves into the multifaceted impact of AI startups on global investment trends, examines the underlying factors behind their rapid ascent, and discusses what the future might hold for investors, entrepreneurs, and regulators alike.

Redefining the Investment Landscape

The digital age has witnessed dramatic shifts in how capital flows within the economy. Traditionally, sectors such as manufacturing, retail, and finance dominated the investment sphere. However, the advent of AI has altered this balance. Startups leveraging AI-driven solutions are now at the epicenter of venture capital interest due to their potential to disrupt conventional industries, optimize processes, and create novel revenue streams. Investors are keen on the promise of exponential growth these startups offer, even though the territory remains fraught with uncertainties typical of early-stage technologies.

AI’s appeal lies in its versatility and adaptability—qualities that are critical in an era of rapid technological and economic change. From predictive analytics to autonomous systems, AI applications have far-reaching implications. Venture capitalists and angel investors increasingly recognize that while traditional sectors provide stability, emerging AI companies have the potential for explosive returns. Their ability to scale rapidly, combined with the allure of first-mover advantages in new markets, has resulted in a surge of investment in this domain.

The Catalysts Behind AI Startup Growth

Several key factors contribute to the meteoric rise of AI startups in the global investment arena:

A. Technological Advancements

Recent breakthroughs in machine learning algorithms, increased computational power, and the availability of vast datasets have dramatically improved AI capabilities. These technological advancements have not only enhanced the performance of AI systems but also expanded their usability across sectors. For instance, industries ranging from healthcare to finance are employing AI for tasks such as diagnostics, risk assessment, and supply chain optimization.

B. Investor Confidence and Market Trends

Investor sentiment has evolved to embrace the high-risk, high-reward nature of AI ventures. Many venture capital firms now maintain specialized funds dedicated solely to AI and emerging technologies. The successful exits of several early AI ventures have further bolstered confidence, encouraging more substantial investments despite the inherent risks. Recent market analyses suggest that AI-related ventures could redefine the landscape of global business, making them a key focus for future funding rounds.

C. Global Economic Shifts

Economic conditions on a global scale have also played a significant role. As emerging markets become more technologically adept and competitive, they are increasingly adopting AI solutions to leapfrog traditional development models. This widespread adoption fuels an ever-growing market for AI products and services, creating an ecosystem where innovation and investment feed off one another.

D. Government Policies and Regulatory Frameworks

Governments worldwide are beginning to understand the strategic importance of AI. Many have initiated policies to foster innovation, offering tax incentives, grants, and public-private partnerships aimed at supporting AI research and commercialization. The supportive regulatory environment not only boosts investor confidence but also ensures a sustainable ecosystem for these startups to thrive.

E. The Demand for Digital Transformation

Traditional businesses are under immense pressure to reinvent themselves in the digital age. As corporations strive for digital transformation, the integration of AI becomes indispensable. This external demand from incumbent industries creates numerous opportunities for AI startups to collaborate, innovate, and grow, further driving investment in the sector.

Investment Implications and Strategies

The influx of capital into AI startups represents both an opportunity and a challenge for investors. While the rewards can be enormous, the volatility intrinsic to early-stage technologies demands a cautious, strategic approach. Here are several strategies investors are adopting in this dynamic environment:

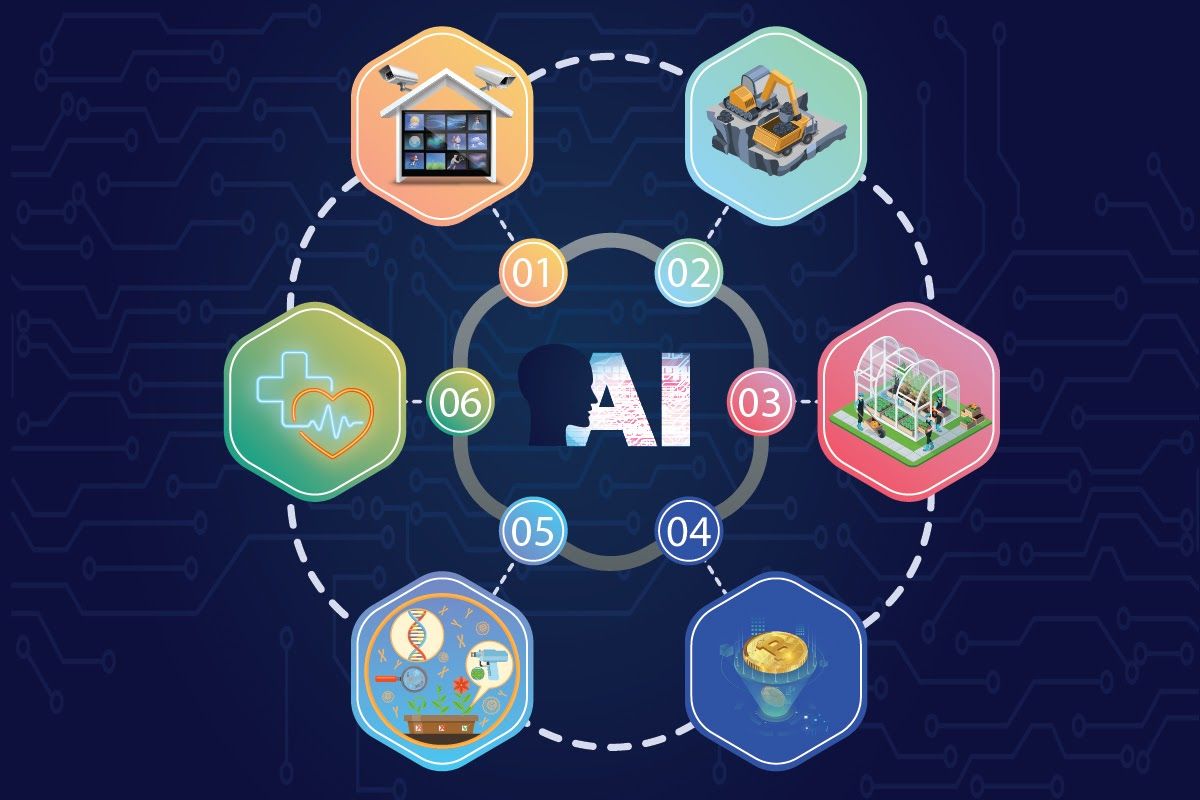

A. Diversification Across Sectors

Given the broad applicability of AI, investors have started diversifying their portfolios beyond the traditional technology sphere. Companies applying AI in healthcare, agriculture, logistics, finance, and even creative industries like art and music are attracting attention. This diversification helps mitigate risk and capitalizes on the widespread benefits of AI adoption.

B. Geographic Diversification

In addition to sector diversification, investors are exploring opportunities in various regions. Regions in Asia, Europe, and Latin America offer burgeoning AI ecosystems with local innovations tailored to specific market needs. Geographic diversity in investment portfolios not only spreads risk but also enables access to localized market insights and regulatory environments that may differ significantly from those in Silicon Valley or other established tech hubs.

C. Early-Stage Funding Versus Later-Stage Investments

The decision to invest in early-stage versus later-stage AI startups often hinges on an investor’s risk appetite and market outlook. Early-stage ventures, while riskier, offer the promise of outsized returns if they succeed in scaling their innovations. Conversely, later-stage investments provide a measure of stability as these companies already have established products and revenue streams. Investors must weigh the trade-offs carefully, often employing a mix of strategies to balance their portfolios.

D. Focusing on Foundational Technologies

Foundational AI technologies such as natural language processing, computer vision, and predictive analytics are essential for the overall ecosystem. Investors are prioritizing startups that are not merely applying these technologies but are actively enhancing or redefining them. This focus on foundational tech can lead to the creation of industry standards that shape the evolution of the entire AI landscape.

E. Partnership and Acquisition Strategies

The competitive nature of the AI sector has spurred a trend towards strategic partnerships and acquisitions. Corporations and established tech giants are frequently acquiring promising startups to integrate innovative solutions into their own portfolios. Such mergers not only validate the startup’s technology but also offer lucrative exit strategies for early investors. Over the coming years, this trend is expected to accelerate, further influencing global investment trends.

Challenges Facing AI Startups

Despite the positive outlook, AI startups face a gamut of challenges that can impact both innovation and investor returns. It is important to consider these hurdles when analyzing the current landscape:

A. Ethical and Social Concerns

The deployment of AI technology often comes with ethical dilemmas. Issues such as algorithmic bias, data privacy, and the potential for job displacement demand careful navigation. Investors and startups alike are now prioritizing ethical guidelines and transparency to build public trust and ensure sustainable growth.

B. Regulatory Uncertainty

While supportive government policies have spurred investment, regulatory frameworks for AI remain uneven. In some regions, ambiguous or rapidly changing regulations add an extra layer of risk. Startups must invest heavily in compliance and legal expertise to ensure they navigate these challenges effectively.

C. Talent Acquisition and Retention

The AI industry faces a talent shortage, with specialized skills in machine learning, data science, and computational statistics in high demand. The competition for top-tier talent often forces startups to offer competitive salaries and benefits, which can strain their financial resources. This challenge is particularly acute for early-stage companies that operate on limited budgets.

D. Integration and Scalability

For many startups, the ability to scale and integrate AI into larger systems presents significant technical and operational challenges. Transitioning from a prototype to a fully operational, scalable solution can be resource-intensive and complex. Moreover, working with legacy systems in established industries often requires substantial customization and flexibility.

E. Competitive Pressures

The rapid growth of the AI sector means that competition is fierce. Not only do startups compete with each other, but they also face competition from established companies entering the AI space. This hyper-competitive environment forces startups to continuously innovate and often leads to rapid pivots in strategy.

The Global Impact of AI Investment

The ripple effects of increased AI investment extend well beyond the technology sector. As AI startups continue to secure funding and disrupt traditional industries, their influence is being felt around the globe in various dimensions:

Economic Growth and Job Creation

AI-driven innovations have the potential to significantly boost economic productivity. By automating routine tasks and optimizing complex processes, AI startups contribute to higher efficiency and reduced operational costs across industries. This, in turn, can lead to job creation in complementary fields such as AI maintenance, data analytics, and cybersecurity, even as some traditional roles become obsolete.

Transformation of Traditional Industries

From agriculture to transportation, AI is catalyzing profound changes in how industries operate. For example, predictive analytics in agriculture can enhance crop yields and reduce resource waste, while autonomous driving technologies are set to revolutionize the transportation sector. AI startups at the forefront of these advancements are reshaping competitive dynamics and compelling traditional players to adopt innovative solutions.

Enhancing Global Competitiveness

Countries and regions that successfully integrate AI into their industrial and economic frameworks are likely to gain a competitive edge on the global stage. Nations like China, the United States, and several European countries have already announced extensive AI strategies, aiming to become global leaders in technology innovation and implementation. Investments in AI not only drive local economic growth but also elevate a region’s status as a hub for technological excellence.

Societal Transformation and Quality of Life

Beyond the economic realm, AI has the potential to improve quality of life across the globe. Enhanced healthcare diagnostics, personalized education, and smarter urban planning are just a few examples of how AI applications can drive positive societal changes. These innovations are particularly impactful in developing regions where they can bridge gaps in infrastructure and services.

Fostering Global Collaboration

The universal appeal of AI technology has fostered unprecedented levels of international collaboration. Cross-border research initiatives, joint ventures between startups and multinational corporations, and shared regulatory frameworks are all contributing to a more interconnected global economy. This collaborative spirit not only accelerates innovation but also helps address global challenges in areas such as climate change, public health, and cybersecurity.

Future Trends and Outlook

Looking ahead, the intersection between AI and global investment trends presents several promising scenarios. While uncertainties will undoubtedly persist, several emerging trends offer insights into the future direction of the market:

A. Evolution of AI Ecosystems

The consolidation and maturation of AI ecosystems is expected to continue. As startups develop more robust solutions and accumulate experience, the market will likely see an increase in specialized sub-sectors. These niches could include areas like AI for environmental sustainability, precision healthcare, and ethical AI applications. Each sub-sector may develop its own ecosystem of investors, regulators, and collaborative partners.

B. Increased Cross-Industry Collaboration

The future of AI is intrinsically linked to its ability to integrate with other emerging technologies such as blockchain, quantum computing, and the Internet of Things (IoT). Collaborative ventures between startups from these diverse domains are already underway. Such cross-industry collaborations have the potential to spawn entirely new business models and value chains, further broadening the scope of global investment opportunities.

C. Rise of Impact Investing

Impact investing is gaining momentum as investors seek not only financial returns but also societal benefits from their capital. AI startups often have the dual potential to drive economic growth and address social challenges, making them attractive candidates for impact investors. As frameworks for measuring social and environmental impact become more sophisticated, the alignment between AI innovations and sustainable development goals will only strengthen.

D. Regulatory and Ethical Standardization

With growing attention on the ethical dimensions of AI, governments and industry bodies are working towards creating standardized frameworks to guide the development and deployment of AI technologies. These initiatives are likely to reduce regulatory uncertainty and foster an environment where innovation thrives alongside ethical accountability. Standardization efforts could include guidelines on data privacy, fairness in algorithmic decision-making, and transparency in AI operations, ultimately benefiting both startups and investors.

E. Expanding Opportunities in Emerging Markets

Emerging markets are rapidly catching up in terms of technological adoption, and AI is at the forefront of this transformation. As these markets mature, they present a fertile ground for AI startups to implement scalable solutions that address local challenges. The increasing digitalization of emerging economies is expected to lead to greater capital inflows, further diversifying global investment portfolios and solidifying the role of AI as a universal driver of innovation.

Case Studies: Success Stories and Cautionary Tales

A deep dive into recent AI startup ventures offers valuable lessons, both inspirational and cautionary, for investors. Here are a few case studies that highlight the varied pathways AI startups can take:

A. Revolutionizing Healthcare Diagnostics

One AI startup focused on revolutionizing diagnostic processes in healthcare successfully developed an algorithm capable of detecting early-stage diseases with unprecedented accuracy. By integrating advanced machine learning techniques and vast medical datasets, the company managed to reduce diagnostic time and improve patient outcomes. This success was a wake-up call for established healthcare providers, who subsequently formed joint ventures to incorporate similar technologies. Investors saw this as a validation of the approach, leading to a surge in follow-on funding rounds.

B. Autonomous Vehicles and Transportation

In the transportation sector, several AI startups have made significant strides in developing self-driving technologies. One notable company, after demonstrating robust testing and successful pilot programs, managed to secure a multi-billion-dollar investment from a consortium of automotive giants. However, regulatory hurdles and safety concerns have also surfaced, serving as a reminder that rapid innovation must be balanced with rigorous risk management and compliance measures. Investors watching this space remain cautiously optimistic, recognizing the transformative potential while being mindful of the risks.

C. Financial Services and Risk Management

AI applications in financial services have proven particularly lucrative. Startups that offer real-time risk assessment, fraud detection, and automated trading systems are transforming traditional banking models. In one instance, an AI-driven risk management startup was acquired by a leading financial institution, leading to a significant return on investment for early backers. This case study underlines the inherent value of combining AI’s predictive prowess with the precise demands of financial markets. It also highlights the importance of continuously adapting algorithms to keep pace with evolving market conditions and regulatory standards.

D. Ethical AI and Responsible Innovation

Another compelling case is that of a startup dedicated to developing ethical AI frameworks. Recognizing the growing concerns regarding bias and transparency, the company created tools to audit and refine algorithms across various applications. Although not as immediately profitable as other ventures, this startup’s commitment to responsible innovation has earned it considerable attention from impact investors and government agencies. Its journey illustrates that success in the AI realm is not solely measured by financial returns but also by the broader contributions to a fair and balanced digital society.

Strategies for Entrepreneurs and Innovators

For AI startups and entrepreneurs looking to enter the competitive global market, developing a clear roadmap is critical. Here are some strategic insights to consider:

A. Establish a Robust Research and Development Framework:

– Invest in cutting-edge research and continually refine algorithms to stay ahead of industry trends.

– Collaborate with academic institutions and research centers to remain at the forefront of technological breakthroughs.

B. Build Strong Ethical Guidelines:

– Develop and adhere to transparent ethical standards that guide AI development.

– Implement measures to ensure algorithmic fairness, data privacy, and accountability.

C. Focus on Scalability and Integration:

– Prioritize designing solutions that can integrate smoothly with existing enterprise systems.

– Plan for scalability early on to accommodate rapid market expansion and increasing user demands.

D. Engage with Investors Early:

– Cultivate relationships with venture capitalists and angel investors who specialize in tech innovations.

– Communicate a clear vision and tangible milestones to build investor confidence and secure follow-up funding.

E. Adapt to Global Market Dynamics:

– Recognize the importance of geographic diversification and tailor solutions to meet regional market needs.

– Monitor global trends and regulatory changes to adapt business strategies accordingly.

The Role of Emerging Technologies in AI Advancement

Integrating AI with other emerging technologies further amplifies its transformative power. The interplay between AI and innovations such as the Internet of Things (IoT), blockchain, and quantum computing is creating an interconnected framework that redefines efficiency, security, and data management. For example, IoT devices generate massive amounts of data that can be analyzed using advanced AI algorithms to optimize resource allocation, predict maintenance needs, and enhance operational efficiencies across industries. Blockchain, on the other hand, offers secure data provenance which is critical in verifying the integrity of AI-generated insights. The coming together of these technologies presents a holistic vision where digital ecosystems evolve synergistically to deliver unprecedented value.

Regulatory Evolution and Its Impact on AI Investments

As the AI landscape continues to expand, regulatory agencies are grappling with balancing innovation with public safety. The evolution of regulatory standards plays a crucial role in shaping investment strategies and operational models for AI startups. Recent discussions among policymakers have centered on creating uniform guidelines for data protection, algorithmic transparency, and ethical AI practices. By fostering an environment of trust and accountability, well-crafted regulatory frameworks can accelerate investment flows, ensuring that innovation is encouraged while societal risks are minimized.

Investment Outlook: Challenges and Opportunities Ahead

The journey of AI startups is marked by both remarkable achievements and formidable obstacles. As we look towards the future, several factors will determine whether this innovative wave continues to dominate global investment trends:

A. Market Maturation: As AI markets mature, investors will likely shift their focus to startups that demonstrate not only technological innovation but also operational sustainability.

B. Adoption Curve: The pace at which businesses across industries integrate AI will significantly influence investment dynamics, potentially creating waves of opportunities in various sectors.

C. Technological Disruptions: Continuous improvements in hardware, algorithm design, and data processing methods will serve as catalysts for further investment.

D. Economic Conditions: Global economic trends, such as inflation rates and geopolitical stability, will also impact investor sentiment and funding availability.

E. Cross-Sector Collaborations: Partnerships between AI startups and established enterprises could emerge as powerful drivers of sustainable growth, merging niche expertise with robust market channels.

Conclusion

The global investment landscape is witnessing a paradigm shift, with AI startups at the forefront of this transformative revolution. Their ability to harness advanced machine learning technologies and redefine the way industries operate is creating new avenues for growth and profitability. As investors navigate the complexities of this dynamic sector, a balanced approach that combines risk management with a visionary outlook will be essential.

The journey is not without challenges—ethical dilemmas, regulatory uncertainties, talent shortages, and intense competition all pose risks. However, the potential rewards of investing in AI-driven innovations are immense. With continued technological advancements, adaptive regulatory frameworks, and global collaboration, AI startups are not only reshaping investment trends but also defining a new era of industrial and societal transformation.

As this landscape evolves, stakeholders—from seasoned venture capitalists to innovative entrepreneurs—must remain agile and informed. Investing in AI is more than just a financial decision; it represents a commitment to shaping a future where technology empowers every facet of human endeavor, driving progress, enhancing quality of life, and creating opportunities that transcend traditional boundaries.